In Malaysia income tax is generally governed by Income Tax Act 1967 Act 531967. Before we dive into the amendments made by the Finance Act 2018 let us refresh ourselves on.

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

This page is currently under maintenance.

. Charge of income tax 3 A. Short title and commencement 2. Section 4 income tax act malaysia Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return Pin On W 4 Form.

B gains or profits from an employment. Income Tax Act 1967- Part 4 in Finance Law v the amount of his reserve fund for unexpired risks relating to any such Malaysian general certificate at the end of the immediately preceding basis period. A b c d e f Business.

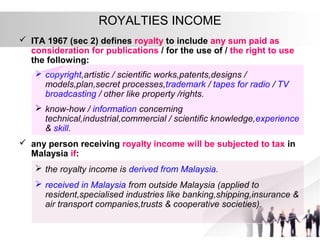

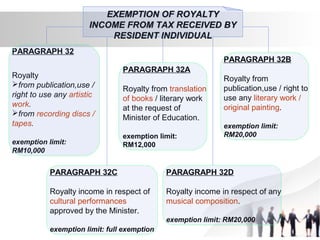

Section 4 of the Act provides for charge of income tax and is divided into two subsections. It will also give the readers an overview of what is income in revenue law. Income falling under Section 4 f of the Income Tax Act 1967 ITA 1967 includes any other income that is not obtained from business employment dividends interests discounts rents royalties premiums pensions or annuities.

Classes of income on which tax is chargeable. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1. The IRB has published Public Ruling PR No.

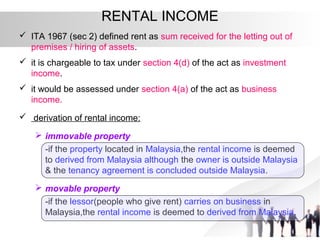

Federal Legislation Portal Malaysia. Repealed by Act 578s4 Section 4. Rental income is filed under Section 4 d of the Income Tax Act 1967.

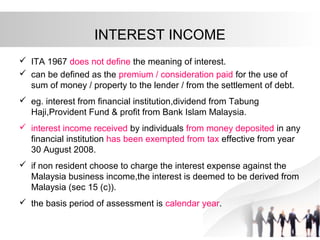

Save upto Rs 46800. Except for those interest that fall under subsection 245 of the ITA. Tax Treatment Interest income is chargeable under paragraph 4a or 4c of the ITA.

Non-chargeability to tax in respect of offshore business activity 3 C. 1 Subject to this section income tax charged for each year of assessment upon the chargeable income of a person who gives any loan to a small business shall be rebated by an amount equivalent to two per cent prorated per annum or such other rate as may be prescribed from time to time by the Minister on the outstanding balance of the loan before any set off is made under. Administrator Rental income is generally assessed under Section 4 d Rental Income of the Income Tax Act and is seen as income from investment.

Classes of income on which tax is chargeable. From the year of assessment 2013 section 4B of the ITA provides that interest income cannot be charged to tax as gain or profit from business under paragraph 4a of the ITA. The new 18-page PR comprises the following paragraphs and sets out 20 examples.

Generally rental income is considered non-business income that is derived relatively passively. 20 Relevant provisions of. Income Tax - Earlier the author believed that we do not need a direct tax code and appropriate amendments to the Income Tax Act 1961 will do the needful.

Special classes of income on which tax is chargeable. If youre renting a property for business purposes however your rental income is filed under Section 4 a of the Act under business income. Income falling under paragraph 4 f chargeable to tax 41 The introduction of a new section 109F of the ITA with effect from 01012009 provides a mechanism to collect withholding tax from a non-resident person who receives income which is derived from Malaysia in respect of gains or profits that fall under paragraph 4 f of the ITA.

Tax rebate on loan to a small business. Section4 incometax taxliability surcharge marginalrelief Chapter II of the Income Tax Act 1961 comprising of sections 4 to 9A deals with basis of charge. Derivation of business income in certain cases 13.

Dividends interest or discounts. When rental income is assessed under section 4 d it has to be grouped into three sources namely residential properties commercial properties and vacant land. Taxation of Income Arising from Settlements dated 13 August 2021.

Payments that are made to NR payee in respect of the above income are subject to the withholding tax of 10. And often allow notional reductions of income. Clue of what section 4 Income Tax Act 1967 trying to classify.

Tax rebate on fees. Under Section 3 of the ITA income tax shall be charged for each year of assessment upon the income of any person accruing in or derived from Malaysia or received in Malaysia from outside Malaysia. D rents royalties or premium.

The new guidelines are broadly similar to the earlier guidelines and explain the penalties that will be imposed under Section 1123 of the Income Tax Act 1967 ITA Section 513 of the Petroleum Income Tax Act 1967 PITA and Section 293 of the Real Property Gains Tax Act 1976 RPGTA where a taxpayer fails to furnish a tax return within the stipulated. 4 Laws of Malaysia ACT 53 Section 11. Manner in which chargeable income is to be ascertained.

Section 7 of the Act sets down 4 circumstances of which an individual can qualify as a tax resident in Malaysia for the basis year for a year of assessment. Section 4 income tax act malaysia. Or Income Tax Act 1967.

Subject to this Act the income upon which tax is chargeable under this Act is income in respect of-a gains or profits from a business for whatever period of time carried on. Commencement of amendments to the Income Tax Act 1967 3. 1 Sections 4 6 13 14 16 17 18 20 21 22 23 24 25 and 27 paragraph 5a paragraph 5b in relation to paragraph 61oof the Income Tax Act 1967 and paragraph 26b in relation to Part XIX of Schedule 1 to the Income Tax Act 1967 come into operation on 1 January 2022.

INCOME TAX ACT 1967 Incorporating all amendments up to 1 January 2006 053e FM Page 1 Thursday April 6 2006 1207 PM. Reference to the updated Income Tax Act 1967 which incorporates the latest amendments last updated 1 March 2021 made by Finance Act 2017 Act 785 can be accessed through the Attorney Generals Chamber Official Portal at the following link. Such income is subject to tax in Malaysia.

Rents royalities or premiums. Pensions annuities or other periodical payments not falling under any of the foregoing paragraphs. Any particular dealing or transactions must come within the walls of scope.

Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3. And b subject to subsection 12 by deducting from that aggregate the amount of--. E following classes of income are liable to income tax pursuant to Section 4 of the Income Tax Act 1967.

Section 4 1 states that when a Central Act specifies the rate or rates at which income tax shall be levied for any assessment year.

Taxation Principles Dividend Interest Rental Royalty And Other So

Income Tax Act 1961 A Comprehensive Overview Ipleaders

All About Tax Audit Under Section 44ab Of Income Tax Act Ebizfiling

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxation Principles Dividend Interest Rental Royalty And Other So

Different Types Of Income Tax Assessments Under The Income Tax Act

Interview Not Enough Americans Pay Income Tax Should They

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Pdf Complexity Of The Malaysian Income Tax Act 1967 Readability Assessment

New Income Tax Rules From April 1 2022 7 Major Changes To Kick In From Today

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Taxation Principles Dividend Interest Rental Royalty And Other So

Flowchart Final Income Tax Download Scientific Diagram

Effects Of Income Tax Changes On Economic Growth

Taxation Principles Dividend Interest Rental Royalty And Other So

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)